Including Life Insurance in Your Estate Plan

The estate planning process can involve many different advisors. You may meet with lawyers, accountants, financial gurus and retirement planners. While each of these professionals offers valuable services, you need to decide which products are right for you and your estate.

Reasons to Include Life Insurance

One of the most commonly overlooked options in estate planning is life insurance. Many people worry about life insurance, thinking that it is terrifying and complex. However, life insurance is actually a very useful and flexible planning tool that can completely revolutionize your estate plan.

In fact, life insurance offers many important benefits as part of your plan, including:

- Cash to pay your funeral expenses, outstanding debts and final taxes

- Proceeds paid to your beneficiary free of income tax

- Proceeds transferable to a trust in the best interest of children, elderly relatives or handicapped beneficiaries

- Funds that may be used to settle marital obligations regarding child or spousal support

- Proceeds to buy out your interests in a business

If you have dependent children, if you are a business owner or if you and your spouse have a large disparity in your incomes, life insurance is a good idea. If for some reason you would die prematurely, this policy can help your family that you have left behind handle the day-to-day costs, mortgage payments or business loans that you leave behind. Your family or business partners will have the peace of mind of knowing that you have thought about the future, and you have provided them with safeguards.

Types of Life Insurance

There are many different variables to consider when it comes to deciding the type and amount of life insurance to include in your estate plan. Some of your considerations should include:

- Your current income and assets

- Your projected income and assets

- Your family’s annual living expenses

- Your family’s current debt load

- The length of policy you are considering

- Future economic concerns, such as a child going to college

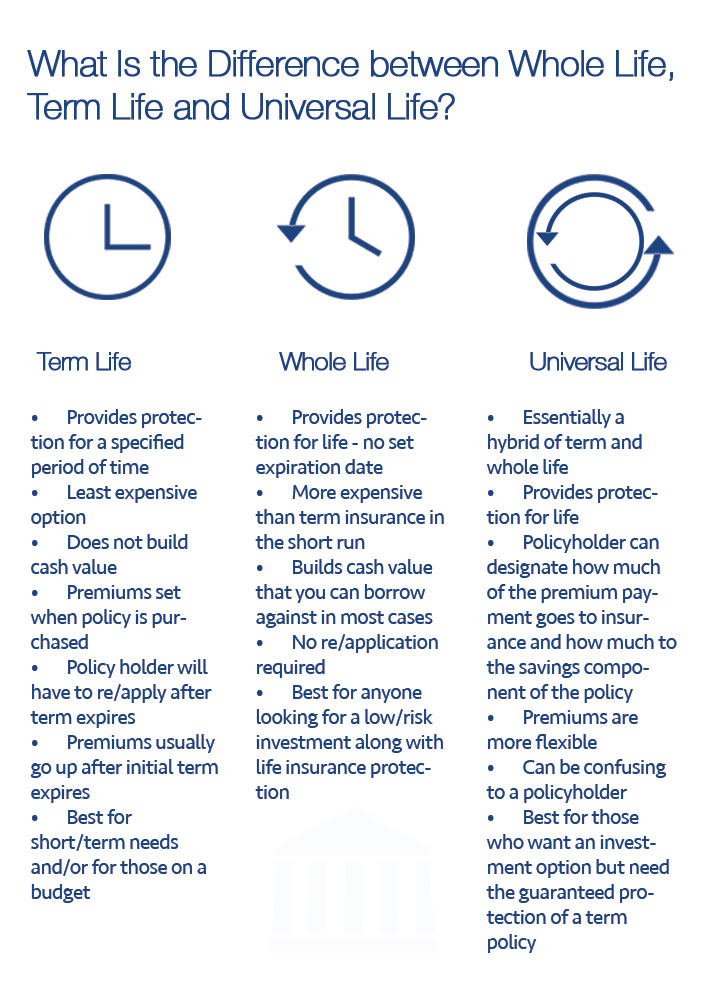

The two basic categories of life insurance are:

- Term life insurance – This is the simplest and least expensive form of life insurance that most people choose to use. When you purchase your policy, you select the time period, usually 10, 20 or 30 years. Because of this set time frame, term insurance is especially useful for people who want to include the policy for a limited number of years, such as until your children are through college or until you reach retirement age. If you are in good health, a term policy will cost you a few hundred dollars a year.

- Permanent life insurance – Sometimes called cash-value insurance, permanent life insurance lasts for the entirety of your life or until you cancel the policy. This is a more common type of life insurance applied to estate planning because it only terminates at the end of your life, and it provides for future expenses and the continuity of your family financial situation. Because it generally lasts much longer, this insurance is much more costly than term life insurance.

- Survivorship life insurance – Also known as second-to-die insurance, this type of policy covers two lives, such as spouses, in a single plan. The pay-out occurs when the second person dies, allowing the proceeds to continue to accumulate for a longer period of time. Most of the time survivorship premiums are slightly lower because the pay-out does not occur early.

Using a Life Insurance Trust

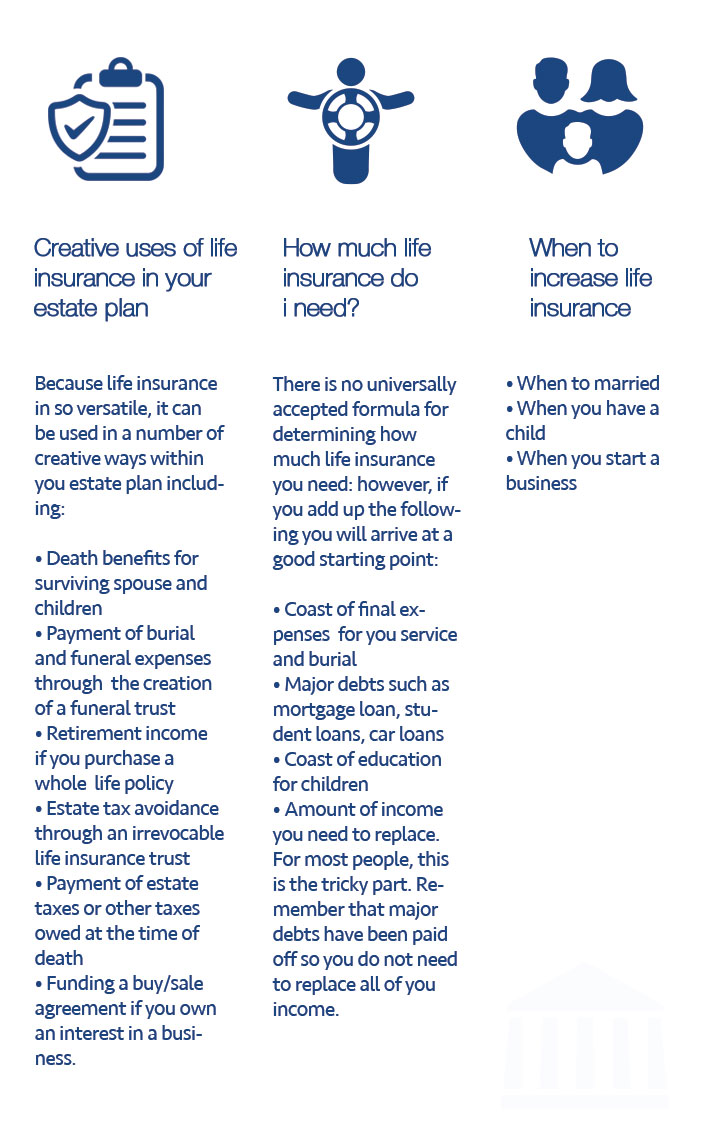

Another option that you may want to consider in your estate planning is an irrevocable life insurance trust. Using this type of trust will give you more control over your insurance policies, help you reduce or eliminate estate taxes and allow you to govern the money that is paid from your policies.

An irrevocable insurance trust involves three main people:

- The grantor who creates the trust (you)

- The trustee you choose to manage your trust

- The trust beneficiaries you select to receive your assets after your death

In this system, your trust owns the insurance policy on your life, and you can create the instructions for your trust that the trustee you selected must honor. These stipulations can allow you to keep the money in your trust for many years into the future until the conditions that you have set make the money available to your beneficiaries.

Consider these examples of trust uses:

- You could provide a lifetime of income for your spouse.

- You could allow your trustee to pay out small distributions to your beneficiaries over time.

- Your trustee could borrow money from the trust as a loan that will be paid back.

- You could allocate your trust just for college expenses for your children and grandchildren.

These are just a few options you have when you use an irrevocable insurance trust with your estate. Best of all, this type of life insurance keeps your money safe from creditors, courts and potentially irresponsible spending by your trustee or beneficiaries.

Revisit Your Plans Over Time

Once you have selected a life insurance plan that makes sense for you and for your family or business, you cannot buy into it and never think about it again. Every time a major life event occurs, such as the birth of a child or a change in your marital status, you have to review your policy and make the appropriate changes. The same is true if one of your beneficiaries passes away or if you move to another state. Each of these events has a profound impact on your insurance and estate plan, and you do not want these issues to affect the pay-out after your death. Schedule a time to meet with your attorney or estate planner as soon as possible.

Some Final Thoughts

Although some people take out a small life insurance policy through their workplaces, most do not take full advantage of these options for their estate planning and final expenses. What you choose as your policy can have a huge, positive impact on your estate, your taxes and your legacy for your family and business.