Talk to an Attorney

To speak with an attorney or ask a question please complete the information below.

Since 1969, countless families have used charitable remainder trusts (CRTs) to increase their incomes, save taxes, and benefit charities.

What does a CRT do?

A CRT allows you to convert a highly appreciated asset such as stock, real estate property, etc., into a lifetime income. It reduces your income taxes now, estate taxes after you pass away, and eliminates capital gains taxes when the asset if the asset is sold. Furthermore, you get to help a charity, or several charities, that are meaningful to you.

How does a CRT work?

A CRT allows you to transfer an appreciated asset into an irrevocable trust. Therefore, it will be essentially removed from your total estate, which prevents the asset from being taxed after you pass away. You will receive an immediate charitable income tax deduction.

The trustee then sells the asset at full market value, while paying no capital gains tax, and re-invests the proceeds into income producing assets. Throughout the duration of your lifetime, the trust will pay you an income. When you pass away, the remaining trust assets go to the specific charity (ies) that you have chosen. This is why it’s called a charitable remainder trust.

Why not sell the asset and reinvest myself?

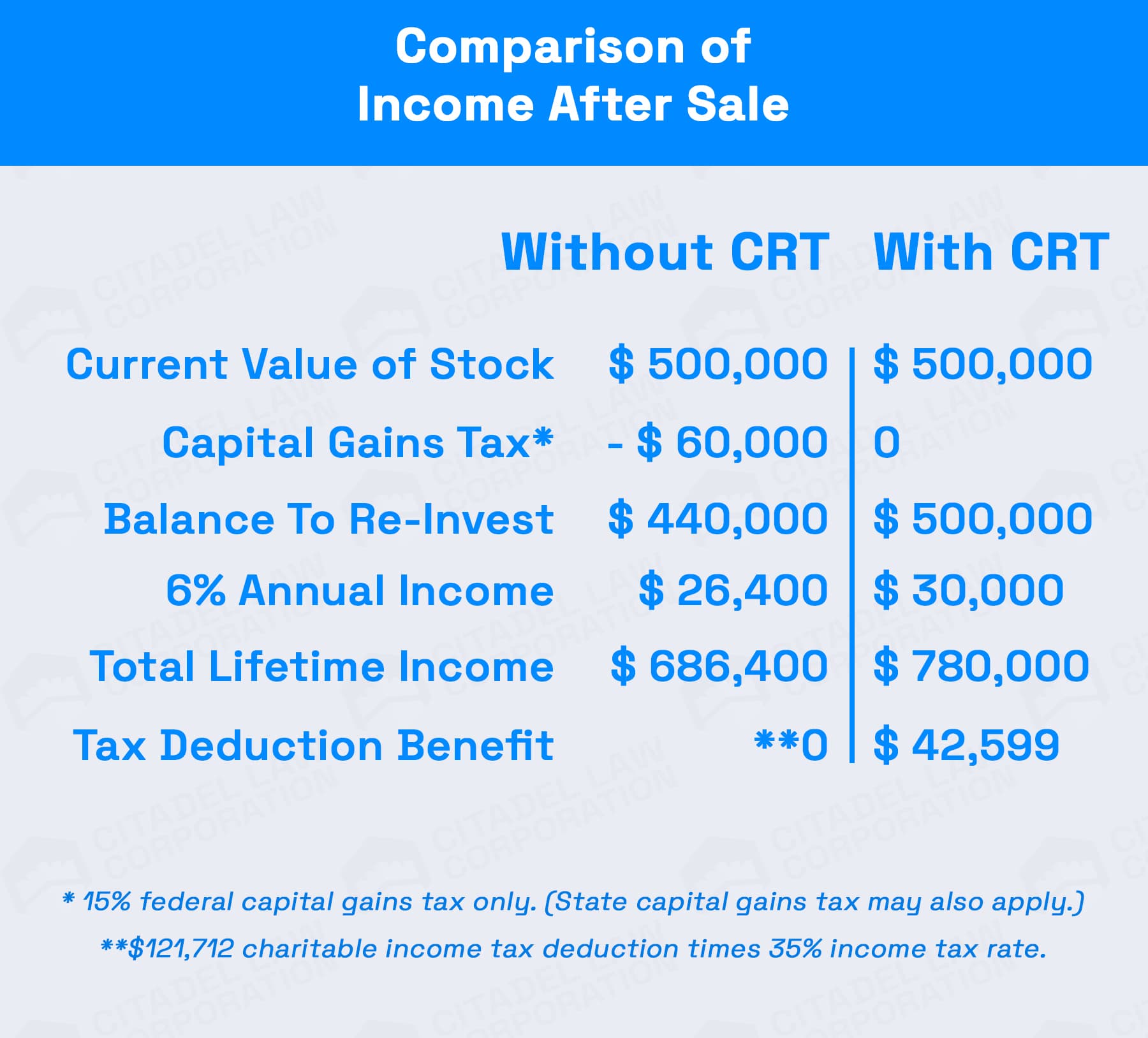

You could, but you would pay more in taxes while receiving less of an income. For example:

Years ago, Max and Jane Brody (ages 65 and 63) purchased some stock for $100,000. It is now worth $500,000. They would like to sell the asset and generate some retirement income.

If they sell the stock, they would have a gain of $400,000, which is the current value at a lesser cost. They would have to pay $60,000 in federal gains taxes, which is 15% of $400,000. That would leave the Brodys with $440,000. (See chart for details).

Comparison of Income After Sale

If the Brodys reinvest and earn a 6% return, that would provide them with $26,400 in annual income. If you multiply this number by their life expectancy of 26 years, this would give them a total lifetime income of $686,400, before taxes. Because they still own the assets, there is no protection from creditors and no charitable income tax deduction available.

What happens if they use a CRT?

If they transfer the stock to a CRT instead, the Brodys can take an immediate charitable income tax deduction of $121,712. Because they are in the 35% tax bracket, this will reduce their current federal income taxes by $42,599.

The trustee will sell the stock for the same amount. (See chart). However, because the trust is exempt from capital gains taxes, the full $500,000 is available to reinvest. The same 6% return will produce $30,000 in annual income, which, before taxes, will total $780,000 over their lifetimes. That’s $93,600 more income than if the Brodys had sold the stock themselves. And because the assets are in an irrevocable trust, they are protected from creditors.

What are my income choices?

You can receive a fixed percentage of trust assets (like the Brodys), in which case, your trust would be called a charitable remainder unitrust. With this option, the amount of your annual income will fluctuate, depending on investment performance and the annual value of the trust.

The trust will be re-valued at the beginning of each year to determine the dollar amount of income you will receive. If the trust is well managed, it can grow quickly since the trust assets grow tax-free. The amount of your income will increase as the value of the trust grows.

Sometimes the assets contributed to the trust (like a real estate property or closely-held corporation), are not readily marketable, so income is difficult to pay. In this case, the trust can be designed to pay the lesser of the fixed percentage of the trust’s assets or the actual income earned by the trust. A provision is usually included so that, if the trust has an “off” year, it can “make up” any lost income in a better year.

Can I receive a fixed income instead?

Yes. You can elect to receive a fixed income, in which case, the trust would be called a charitable remainder annuity trust. This means that regardless of the trust’s performance, your income will not change.

This option is a good for choice for those who are in their later years of life. It doesn’t provide protection against inflation like the unitrust does, but some people like the security of a definitive income each year. It is best to use cash or readily marketable assets to fund an annuity trust.

In either a unitrust or annuity trust, the IRS requires that the payout rate stated in the trust cannot be less than 5% or more than 50% of the initial fair market value of the trust’s assets.

Who can receive income from the trust?

Trust income is generally taxable in the year it is received. It can be paid to you for your lifetime. If you are married, it can be paid for the duration of both of your lifetimes.

The income can also be paid to your children for their lifetimes, or to any person or entity you wish, providing the trust meets certain requirements. In addition, there are gift and estate tax considerations if someone other than you receives the income. Instead of lasting for someone’s entire lifetime, the trust can also exist for up to 20 years.

Do I have to take the income now?

No. You can set up the trust and take the income tax deduction now, but postpone taking the income until later. With good management, the trust assets will have appreciated considerable in value by then, giving you a larger income.

How is the income tax deduction determined?

The deduction is based on the amount of income received, the type and value of the asset, the ages of the people receiving the income, and the applicable federal rate (AFR), which fluctuates. (Our example of the Brodys is based on the 5.4% AFR). Generally, the higher the payout rate, the lower the deduction.

It is usually limited to 30% of adjusted gross income, but can vary from 20% to 50%, depending on how the IRS defines the charity and the type of asset. If you can’t use the full deduction the first year, you can carry it forward for up to five additional years. Depending on your tax bracket, type of asset, and type of charity, the charitable deduction can reduce your income taxes by 10-30%, or even more.

What kinds of assets are suitable?

The best assets are those that have greatly appreciated in value since you purchased them-specifically, publicly traded securities, real estate property, and closely-held corporations. Mortgaged real estate, however, won’t usually qualify. (You may consider paying off the loan instead.) Cash can also be used.

Who should be the trustee?

You can be your own trustee, but you must be sure that the trust is administered properly. Otherwise, you could lose the tax advantages and/or be penalized. Most people who name themselves as trustees have the paperwork handled by a qualified “third party administrator.”

However, some people select a corporate trustee, which is a bank or trust company that specializes in managing trust assets. They do this because a corporate trustee has experience in investments, accounting, and government reporting. Some charities are also willing to be trustees.

Before naming a trustee, it is a good idea to interview several candidates and consider their investment performance, services, and experience with these types of trusts. Remember, you are depending on the trustee to manage your trust properly and provide you with the most amount of income possible.

Do I still have some control?

Yes. For as long as you live, the trustee you select (not the charity), controls the assets. Your trustee must follow the instructions you put in your trust. You can retain the right to change the trustee if you become dissatisfied. You can also change the charity to another qualified charity without losing the tax advantages.

Can I make any other changes?

Generally, once an irrevocable trust is signed, you cannot make any other changes. Be sure you understand the entire document and are certain that it is exactly what you want before you sign it.

Sounds great for me. But if I give away the asset, what about my children?

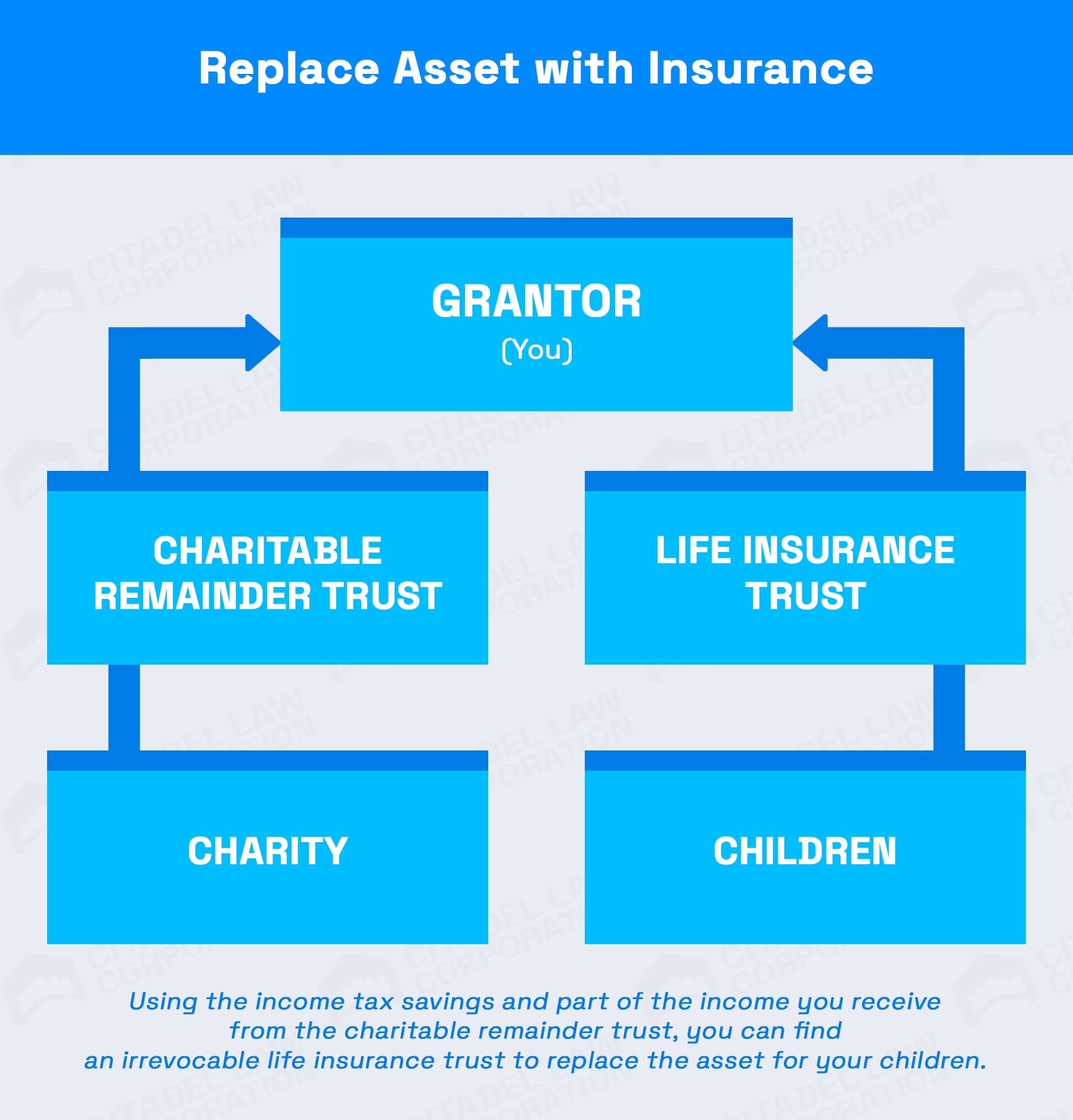

If you have a sizeable estate, the asset you place in a CRT may only be a small percentage of your assets, so you children may be well taken care of. However, if you are concerned about replacing the value of this asset for your children, there is an easy way to do so.

Replace Asset with Insurance

As the illustration (below, left) shows, you can take the income tax savings, and part of the income you receive from the charitable remainder trust, and fund an irrevocable life insurance trust. The trustee of the insurance trust can then purchase enough life insurance to replace the full value of the asset for your children or other beneficiaries.

Why use a life insurance trust?

With a trust, the insurance proceeds will not be included in your estate, so you avoid estate taxes. You can keep the proceeds in the trust for years, making periodic distributions to your children and grandchildren. Furthermore, any proceeds that remain in the trust are protected from irresponsible spending, creditors who are looking to garnish the money, and even ex-spouses.

Life insurance can be an inexpensive way to replace the asset for your children, since every dollar you spend in premium buys several dollars worth of insurance. Insurance proceeds are available immediately, even if you and your spouse both die tomorrow. You will also be able to avoid probate and income taxes, in addition to avoiding estate taxes.

So what's the catch?

There really isn’t one. If you combine a charitable remainder trust with an irrevocable life insurance trust, it’s a winning formula for you, your children, and the charity of your choosing.

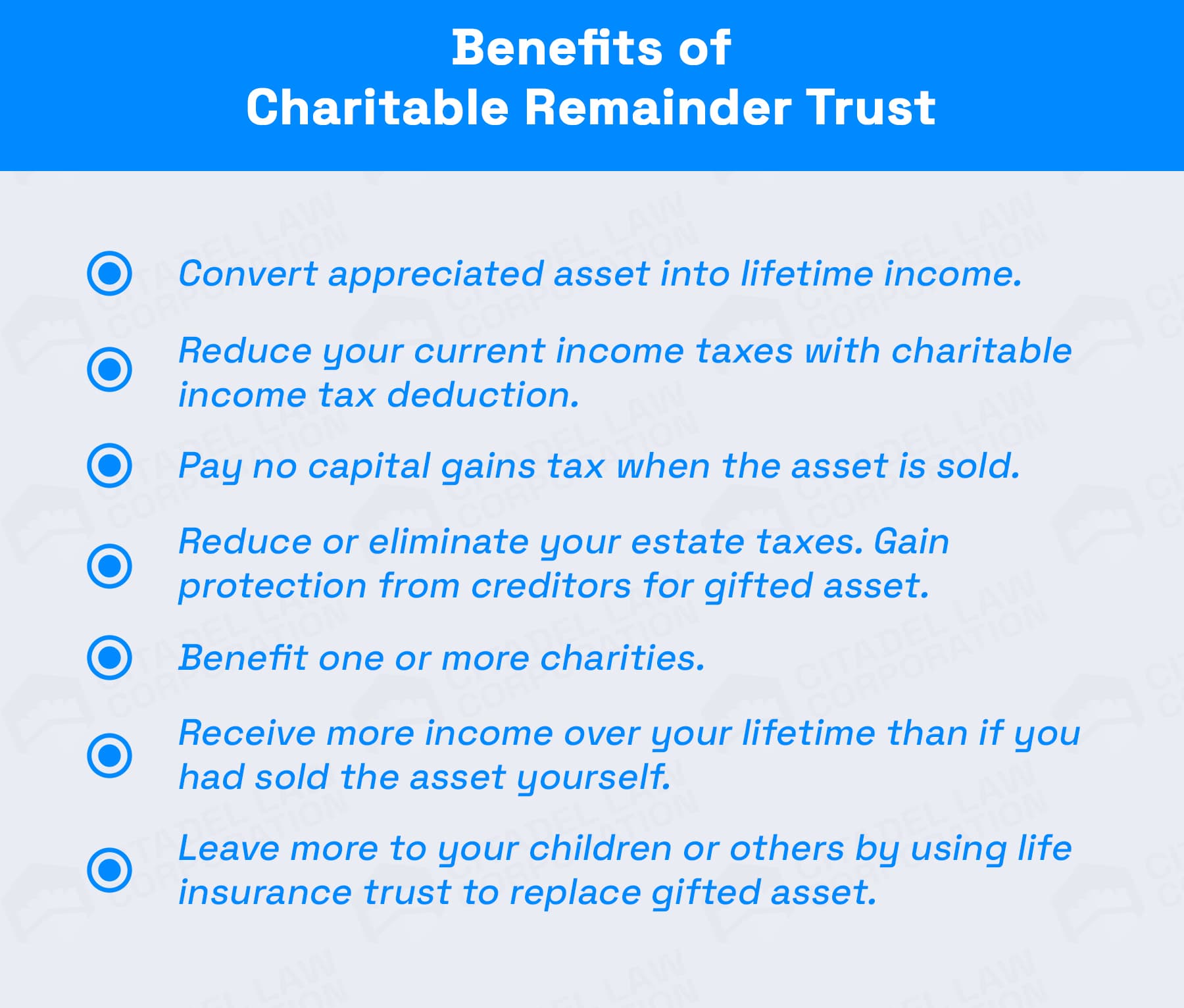

You convert an appreciated asset into a lifetime income. You receive an immediate charitable income tax deduction, which reduces your current income taxes. You remove the asset from your estate, which reduces estate taxes when you pass away. Furthermore, because you pay no capital gains tax after the asset is sold, you will receive more income than if you personally sold it.

With the life insurance trust replacing the full value of the asset, your children receive much more than if you had sold the asset yourself, and paid capital gains and estate taxes. Plus, the proceeds are free of income and estate taxes, as well as probate.

Finally, you will be making a substantial gift to a favorite charity. Because the charity knows it will receive the gift at some point in the future, the charity can plan projects and programs now, which benefit causes that you care about.

Should I seek professional assistance?

Yes. If you think a charitable remainder trust would be valuable for you and your family, speak with a tax-planning attorney, insurance professional, corporate trustee, investment advisor, CPA, and/or a favorite charity. Make sure that you have an experienced attorney prepare the necessary documents.

Benefits of Charitable Remainder Trust?

Charitable Remainder Trusts (CRT’s) are effective for selling appreciated assets without capital gains taxes. They also allow for creating a retirement income and income tax deductions for the grantor, all while benefiting a great charitable cause. A CRT is an irrevocable trust established for the lifetime income benefit of the grantor, with the remainder of the trust corpus passing to a charitable beneficiary upon the death of the grantor. Typically, the grantor will contribute appreciated property to the CRT, which will in turn be sold by the trustee of the CRT without the added capital gains tax. After the sale, the trustee of the CRT will then invest the after-sales proceeds in a manner that will generate an income sufficient to pay the grantor a regular unitrust payment, which is equal to a pre-established percentage of the value of the trust assets per year. This is called the payout rate, or the unitrust percentage. The unitrust payment must be at least 5%, but depending on the age of the grantor, it can be substantially higher, often around 6-8%, or more. Income payments can last throughout the lifetime of the grantor, and can even be extended for up to an additional 21 years for another income beneficiary selected by the grantor.

In addition to the lifetime income, the grantor will also receive a charitable income tax deduction, which is equal to the present value of the remainder interest of the gift. There are specific rules and parameters for calculating and claiming the income tax deductions. The value of the tax deduction is calculated as a function of the grantor’s age, the value of the property, the payout rate of the unitrust, and the applicable federal rate of interest. Even though the charity will not receive any of the trust assets until after the death of the grantor, the grantor will receive an income tax deduction at the time of the contribution. The value of the income tax deduction, which is equal to the present value of the remainder interest, is therefore somewhat less than standard charitable contributions, in comparison to regular charities where the charity has immediate use of the money. The grantor can choose the charitable beneficiary, however, and can even retain the right to change the beneficiary during his or her lifetime.

Ready to Protect Your Legacy?

Start your estate plan today and give your family peace of mind. Secure your documents, plan your future, and ensure your wishes are honored.