About the Taxation of Charitable Trusts

If donating generously to a charity is important to you, then you can accomplish this act of altruism in several ways. For instance, you can submit as many small charitable gifts as you wish, or you can make one large contribution. When it comes to large sums, consider setting up a charitable trust. This type of trust not only allows you to donate to your favorite charity, but it also provides income to you while you’re still living. Oftentimes, people choose to set up a charitable trust because the legal arrangement comes with tax deductions.

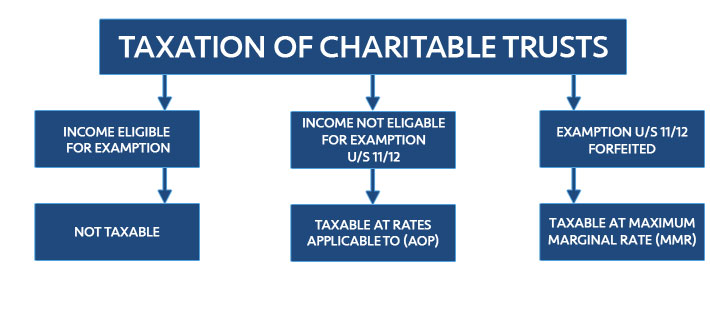

The Taxation of Charitable Trusts

The IRS reports that a charitable trust is considered a private foundation unless it includes elements that allow it to be classified as a public charity. In most cases, charitable trusts are subject to the private foundation excise tax provisions as well as to the other conditions that apply to private foundations.

Keep in mind that the IRS does not classify a charitable trust as an altruistic organization for tax exemption purposes. Also, the trust is subject to the agency’s excise tax according to its investment income rather than being under the rules that apply to tax-exempt foundations.

How Does a Charitable Trust Work?

Of this type of legal arrangement, charitable remainder trusts are the most popular. To put one in place, you'll need to complete the setup process. Then, transfer it to the charity that you’ve selected for your donation. To ensure that the trust gives you the tax breaks that you’re seeking, make sure that the charity is one that the IRS recognizes as tax exempt.

Under a charitable remainder trust, the charity will be the trustee of the legal arrangement, and as such, it will oversee the donation and invest it. This ensures that the trust generates income for you. The charity will pay you a portion of the amount that the trust generates for a specified number of years. You can set the terms of the trust to pay you for the remainder of your life, or you can arrange for it to pay someone you name for a certain number of years. The donation will go to the charity upon your death or when the payout term ends.

What are the Tax Advantages of a Charitable Trust?

Along with aiding a charity that inspires you, a charitable trust gives you a number of tax benefits. This includes allowing you to take an income tax deduction. You will be able to take this deduction for a period of five years while the amount that you can claim is for the value of your charitable contribution. This seems simple, but determining your deduction amount is a little tricky. The value of your charitable contribution is not just the value of the property because the IRS decreases the income total based on the amount that the charity pays you.

For instance, if you decide to donate $200,000 as a charitable contribution with $50,000 coming to you each year, then the value of your donation is $150,000. Once the trust becomes the property of the charity, it’s no longer a part of your estate. This means that it won’t be subject to federal estate taxes.

You can also avoid capital gains tax with a charitable trust. If the charity is able to invest your donation successfully by causing it to appreciate, you won’t have to pay a capital gains tax on the profit. Often, charities sell non-income generating assets when they are a part of a charitable trust. Once it’s sold, they will use the proceeds to purchase property that generates income. Since the IRS does not require charities to pay capital gains tax, the profits remain a part of the trust that isn’t subject to tax.

An example of this is stock. If you own a stock that is worth $500,000, you could transfer it to a charitable trust instead of selling it. In this scenario, the charity would sell your stock and invest the money in a mutual fund. You would then receive income from the $500,000 for the rest of your life. If you were to sell the stock personally, you would owe a capital gains tax on the profit.

Payment Structuring Options

Ajay Sarkaria, a wealth-planning expert for Fidelity Investments, commented on the payment structuring options under a charitable trust. He said, “With these types of charitable trusts, you can control the timing of your charitable donation, choose whether to make it into a lump sum remainder or income stream and decide how much your heirs can benefit from the income or remainder.”

If you choose a lump sum remainder, keep in mind that once you select the amount, you can’t change it later. For example, if you require the charity to pay you $20,000 a year for the rest of your life, you won’t be able to change it to $25,000 a few years later because inflation made your budget a little tight. In theory, you could make the payment amount for as much as you want initially, but when it comes to the practical application, there are limits. If you choose a higher income, then you will reduce the amount that you can claim as an income tax deduction. Also, by using too much, you won’t leave the charity a donation. They're also unlikely to accept the gift.

Major Considerations

Along with the advantages of setting up a charitable trust, the legal agreement requires a few major considerations. For one, this kind of arrangement comes with setup and continuous maintenance costs, so be sure to assess these fees before selecting it. Also, while the trust offers tax benefits, the IRS has regulations about the amount that you must leave to the charity to qualify for them. It’s important to discuss the pros and cons of a trust with your tax and estate-planning adviser to ensure that you’re using the best option for you and your loved ones.