Regardless of Your Age, You Need an Incapacity Plan

You might think that incapacity only happens to the elderly. Although it is true that your chances of becoming incapacitated increase as you age, an accident or illness resulting in incapacity can strike at any age. Statistically, you have a 25-percent chance of suffering from a short- or long-term incapacitation between launching your career and reaching retirement age. Should you become incapacitated and unable to speak for yourself, who will manage your assets, care for your children, pay your bills, conduct the daily operation of your business or make medical decisions on your behalf? Without an incapacitation plan, the answers are unknown, and the risk exists that a stranger could be the one handling your affairs as a court-ordered conservator.

The Weaknesses of Wills and Living Wills

A will is a vital part of your estate plan. It specifies the distribution of your assets after your death. However, none of the terms of your will can be honored while you are alive, so a will is of no value if you become incapacitated. A living will, which is sometimes called an advance medical directive, defines how you wish to be treated should you become terminally ill or suffer from a catastrophic injury, and it is another essential part of your estate planning. A living will is limited in scope, however, so if your condition is not considered irreversible or terminal, medical professionals may not be obligated to follow your wishes if you are incapacitated.

The Weaknesses of Joint Ownership

Some people try to make it easier to transfer ownership by listing their heir on a deed or bank account. Real estate sales require the signatures of both owners, and if you are incapacitated, the property cannot be sold or mortgaged. With a bank account, the other party has immediate access to your funds, so you no longer have sole authority. Furthermore, your assets can be at risk from debts or judgments made against the person who shares ownership with you. Joint ownership is an excellent idea in some situations, but it is not ideal under all circumstances.

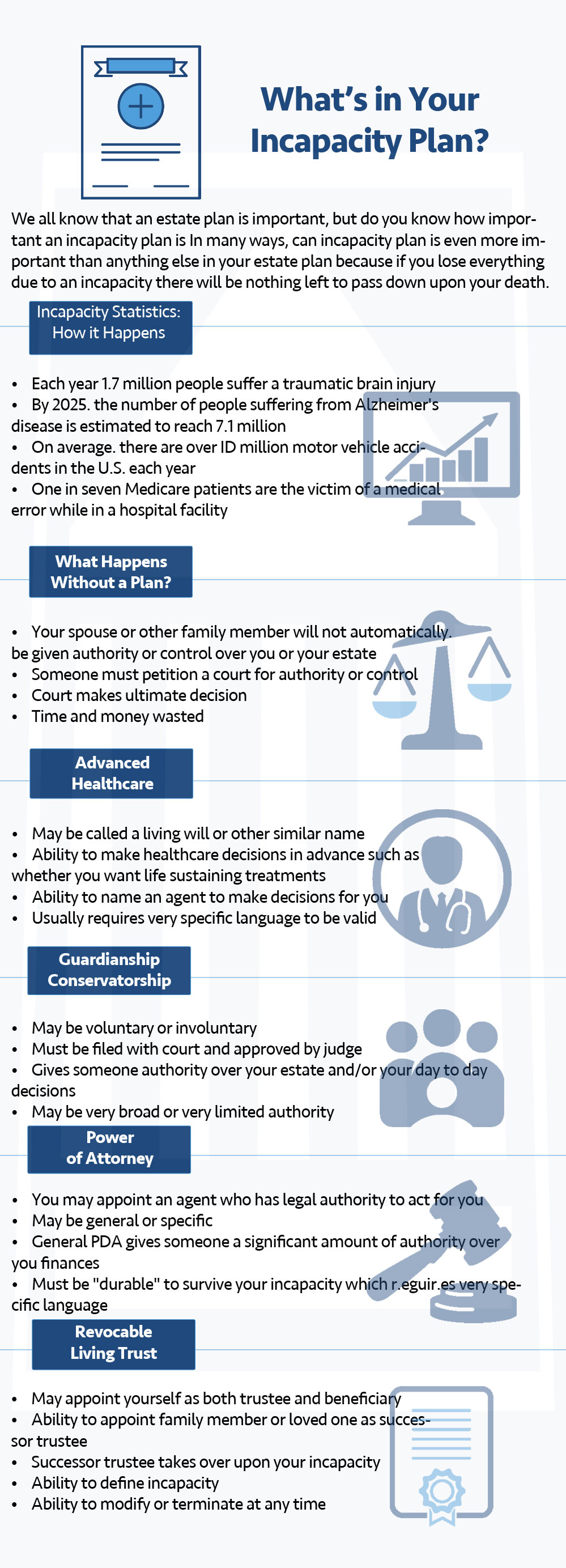

What an Incapacitation Plan Includes?

Incapacitation plans vary by individual. Your plan should be based on your particular situation. For example, if you own a business, you will need to specify whether the business should continue to operate without you or be sold to raise money for your family, and you will need to name the person who will be responsible for managing the business or approving the sale. Here are some of the most common elements included in an incapacitation plan.

Revocable Living Trust

A revocable living trust must be created before you become incapacitated. These trusts have three parties: the grantor, the trustee and the beneficiary. The grantor is the party establishing the trust, the trustee is the party authorized to manage the trust's assets and the beneficiary is the person who receives the benefits from the trust. Until you become incapacitated, you can be the grantor, trustee and beneficiary. You will appoint the trustee and beneficiary who will step in if you become incapacitated or die; the trustee and beneficiary do not have to be the same person.

The next step is to transfer your assets to the trust. Your bank accounts, business, home and other assets can all be transferred. You are not required to transfer every asset, but any assets you do not transfer cannot be managed by your successor trustee under the terms of the trust. Unless you become incapacitated, your assets remain under your control throughout your life. Should you die, the assets in your trust pass to your named beneficiary. You can revoke the trust at any point prior to your incapacitation or after your recovery.

Financial Power of Attorney

This legal document gives the named party the authority to make financial decisions for you. They may manage your investments, sell your property, file your tax returns or handle any other financial matters that you list in the document. Powers of attorney can be either durable or springing; the durable type becomes effective immediately upon signing, but the springing power of attorney does not become effective unless you become incapacitated.

Medical Power of Attorney

This document authorizes the person of your choice to make decisions related to your medical care. Your two powers of attorney can name the same person, but they can also name different people. You can specify the types of decisions that your agent may make, such as arranging your transfer to a different facility or selecting a physician.

HIPAA Authorization

Due to existing privacy laws, your doctor or hospital may be unable to release information on your condition to certain people. For example, a spouse may be able to obtain the information, but your significant other may be denied the information. The HIPAA authorization form lists the names of people authorized to receive your diagnostic, medical or treatment records. Without adequate information, your agents and loved ones may have difficulty making the best decisions for your care.

How to Create an Incapacitation Plan?

An effective incapacitation plan can contain a number of legal documents, and consistency between the documents is vital. Consulting an attorney with expertise in establishing incapacitation plans can help you ensure that you have the right elements in place to protect your interests and comply with your state's requirements.

Prior to visiting an attorney, you might want to consider what would happen if you should become incapacitated. What kind of support would your spouse or children need? Who would be the best person to manage your business affairs? Who should make medical decisions for you? What assets would you need to transfer if you decide to create a living trust? Who will manage this trust during your incapacitation? Do you have a preferred physician or hospital?

Make notes to help you remember your answers during your consultation with an attorney. You should also make a list of questions you need to ask to ensure your own peace of mind.

Although it is possible to create an incapacitation plan or certain parts of it without professional assistance, it is not advisable. Inconsistencies between documents could invalidate all or part of your plan, leaving your loved ones with few options other than a costly and lengthy legal battle. You could also subject them to the necessity of making painful decisions without the benefit of truly knowing your wishes. Call or visit us today to find out more!