To speak with an attorney or ask a question please complete the information below.

9777 Wilshire Blvd. #400, Beverly Hills, CA 90210

beverly-hills@citadel.law424-239-6433

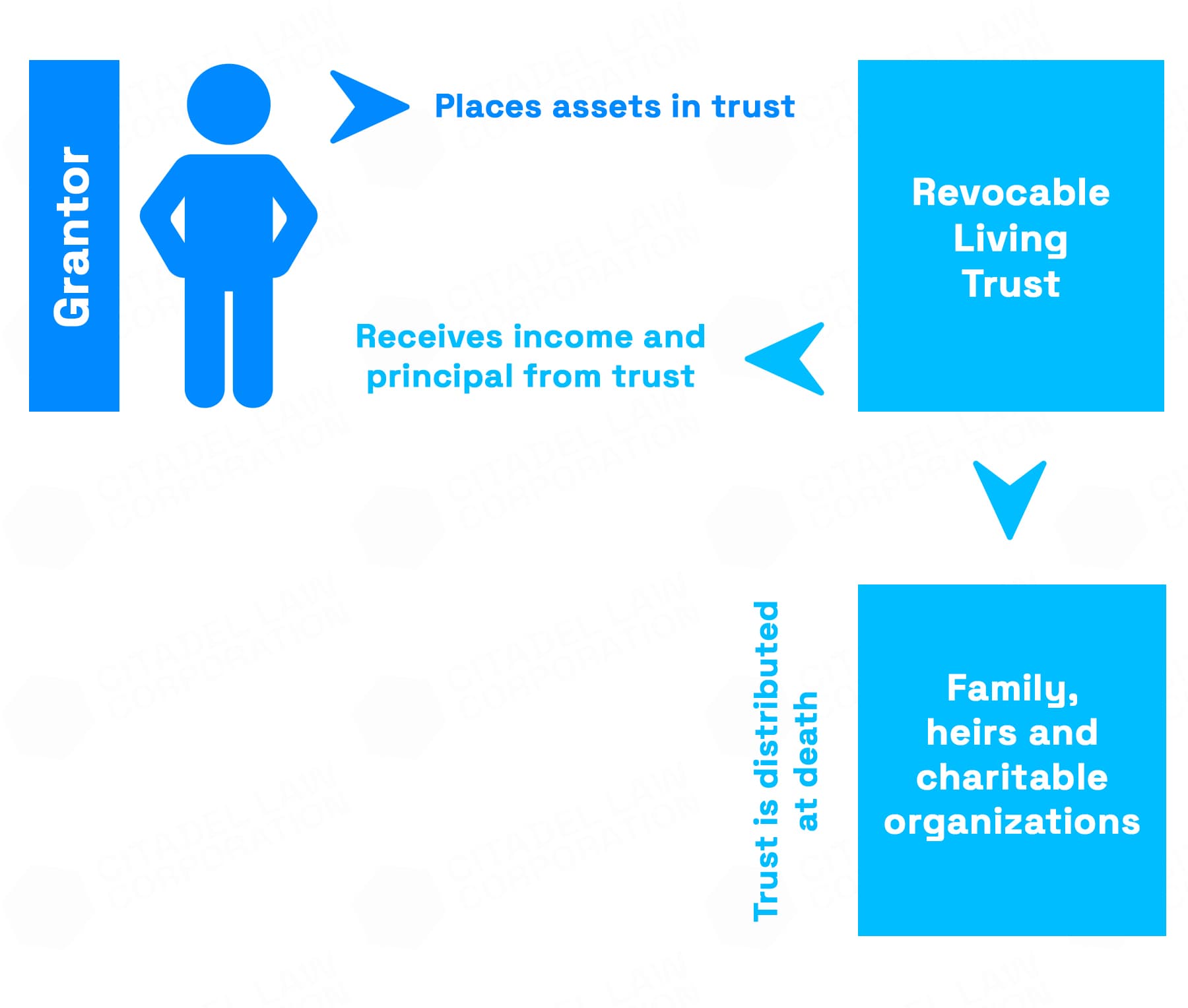

A revocable living trust can be simply thought of as a legal document that serves the purpose of managing a person's assets. When assets are placed in this type of estate planning tool, they can be easily managed and transferred when necessary without the need for probate or other confusing legal processes.

It's important to take a moment and discuss the differences between revocable and irrevocable. Revocables can be changed at any point in time by the grantor, assuming they are deemed competent to do so. Contrarily, irrevocable trusts may only be altered via a court order or if all of the beneficiaries agree to do so.

Advantages of Revocable Living Trusts

This type of legal entity can provide so many great advantages for those who decide to use it. Just like any other estate planning tool, it's a good idea to fully understand how it works to determine if it's the right fit to meet your future goals.

-

Easy Alterations. One of the biggest advantages of this type of estate planning tools is that it can be easily altered by the grantor. There's no need to worry about court orders or getting trustees to agree to a change. Most people that establish a revocable living trust do so with the intention of passing their valuable assets down to their heirs, also known as beneficiaries.

-

Set Precise Conditions. One great benefit of this type of tool is that the grantor can specify precise conditions that must be met in order for a beneficiary to inherit an asset. For example, they may state that they must be employed at a particular company for a set amount of time or earn a specific college degree.

-

Avoid Probate. Another significant advantage of revocables is that they allow the grantor's assets to avoid probate after their death. Contrary to what you may initially think, a probation revocation attorney isn't what you need for this type of estate planning tool. Rather, an estate planning attorney will be able to assist you in establishing your revocable tool to avoid the probate process entirely. This will greatly shorten the amount of time it takes to transfer assets to its heirs.

-

Enhanced Privacy. Apart from making things smoother for everyone involved, this type of estate planning tool is known for its ability to provide more privacy for the grantor. Since there will be no assets going into probate after the grantor's death, there are no public eyes seeing what the grantor has passed down to their heirs through this setup.

Disadvantages of Revocable Living Trusts

One of the biggest disadvantages of this type of living trust is that it can be cumbersome to first establish and somewhat to maintain. The grantor will need to go through the process of retitling all of their assets into the living trust. They will also need to file revocable living trust tax returns annually.

Another known disadvantage of revocables is that they aren't completely protected against creditors. If the grantor is sued while still living, they can lose some or all of the assets. This is due to the fact that they technically still have some control over the assets in the living trust.

Revocables don't provide grantors or heirs with any tax advantages. Since the grantor is still maintaining control of their assets, they don't get any breaks from estate or income taxes. Additionally, heirs who are named as asset owners after the grantor passes are still responsible for regular inheritance tax on the assets that they receive.

Revocable Trust vs. Will

One of the biggest questions that people have when they first learning about living trusts is "How they differ from a traditional will?". The main difference between the two is that a revocable allows one to transfer assets to their heirs with the avoidance of probate. This saves a lot of time when it comes to officially transferring assets after the grantor's death.

Also, revocables has the added advantage of being able to officially recognize who can manage the grantor's affairs if they become mentally incapacitated. This saves the trouble of having to deal with revocation power of attorney forms and other power of attorney documents. When it comes to having a will, all of the grantor's assets must go through the probate process unless they're part of the rare few that meet any state exemptions.

How to Create a Revocable Living Trust

Setting up a living trust that is revocable isn't overly difficult to do with the right guidance from an experienced lawyer. It involves three main steps. The first is to create a trust document, which is simply a written agreement that shows your assets. You'll want it to include a list of heirs, who receives what, and determine the name of the trust that you're establishing.

Once the document has been prepared by a trusted source, it's time to sign and notarize it. This will make the document official to be recognized by the government. The third and final step will be to transfer your assets into the trust. This includes everything you listed, from bank accounts to real estate and vehicles. All assets must be retitled in the name of the new entity.

Do I Need a Lawyer to Set Up a Revocable Living Trust?

While it isn't legally required to have a revocable trust attorney establish your living trust, it's highly advisable to do so. This will help to ensure that the trust document is set up how you would like and in a fashion that is legally binding. Additionally, an experienced estate planning attorney can assist you in answering any questions that you may have throughout the process.

Contact Citadel Law Corporation at (800) 662-0882 today to set up a consultation with an estate-planning attorney if you are interested in creating a revocable living trust in Southern California.

We are here to answer all of your legal questions!

Our attorneys are waiting to help you